In Tokyo, Toshiba and a consortium led by Bain Capital Private Equity together signed a deal on Thursday in order to sell the Japanese electronics company’s offering of computer memory chip business, a move that was much opposed by Toshiba’s US joint venture partner Western Digital. The consortium also includes Apple Inc and Dell Technologies Capital as the U.S Investors who will not be acquiring the common stock or the voting rights over one’s business. The selling price of Toshiba Memory Corp. is being priced at 2 trillion yen ($18 billion).Toshiba Corp…, also has railroad cum nuclear energy units.

Read Also: IBM Beats Microsoft-is Top Blockchain Technology Leader

Western Digital has been against the deal and threatened Toshiba with legal action. They have opposed the sale of the Nand flash-memory SanDisk joint venture. Toshiba, on the other hand, plans to go on with the deal despite the litigation threat of Western Digital.

The U.S. investors also include Kingston Technology Corp. along with Seagate Technology, who will be investing nearly 415.5 billion yen ($3.7 billion).

On the other hand, the Japanese companies will be holding more than 50 percent of the existing common stock in the consortium’s specially recognized company, known as Pangea, which also has plans to get about 600 billion yen ($5.3 billion) in the form of loans.

Others participating in the consortium is SK Hynix of South Korea, which will be investing nearly 395 billion yen ($3.5 billion).

The Innovation Network Corp. of Japan and the Development Bank of Japan are also interested in putting money into Pangea, according to Toshiba.

Toshiba has suffered a massive amount of losses that are related to its existing U.S. nuclear operations at the Westinghouse Electric Co., which did file for bankruptcy earlier this year. Toshiba had issues with its auditors and could have been delisted. But, eventually, the auditors signed off in the month of August after thorough investigations were carried out about whether Toshiba knew about its losses in advance that were related to Westinghouse acquisition of CB&I Stone & Webster which is nuclear construction and service business.

Toshiba‘s main responsibility is keeping under control and decommissioning of the Fukushima Dai-ichi nuclear plant, where the three reactors had sunk into meltdowns after a rather massive earthquake and tsunami in 2011.

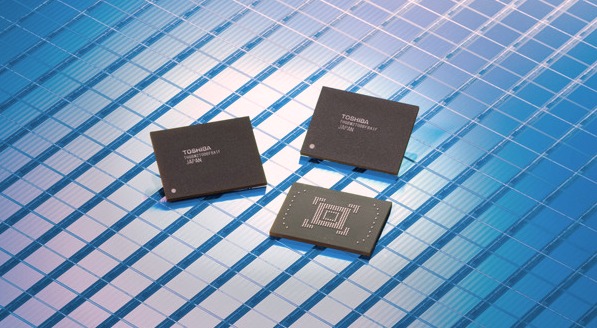

Toshiba and Apple have indeed gone into the business of memory chips and, although, Toshiba is involved in several controversies, yet Toshiba along with the consortium members are indeed planning a big launch in memory chip business.

The business world is full of challenges and deals are made to come up with better products that would sell well in the market. Toshiba also believes in this approach and has made a sensible deal with other companies in the sale of memory chips. Apple has also joined in this big business venture and the role of the latter is important as it has carved a distinguished niche in the mobile market of the world. Attaining success in business requires much tenacity and a sharp acumen to win over consumers.